Monday, March 31, 2008

Yay, last tax form in

Well, I can finally file my taxes. It sure takes a long time to get mutual fund tax info. Though I suppose the rules say that they need to be mailed out today. Anyway, that should be about 2K coming to me from that, probably 4K recovered from loans and 1.5K of pay after expenses this month, 7.5K in total, 6K in reserve. 13.5K to fund my core. If I can get 6%, that should put me at 10% of the red line. I wonder if that'll make me feel any better. It's an extra paycheck. Hmm, how else can I think of it? 4% towards doubling my income, 1/15th of the way towards the "you typically need 60% of your pre-retirement income in retirement" mark. It's also enough money to pay off my loans, which is still a very tempting. Do I need to revisit this one more time? Or perhaps the thing to do is see what interest rates do. The next interest rate announcement is on April the 22nd. Though then I have to consider the impact of the announcement on yields. Well, the some now and some later approach works well. Meh, too late to figure it out tonight. Well, it's already past midnight, so definitely too late now. Morning works though.

An Income Investment Perspective of Money

I've never had a budget before. As a student, I had a simple goal of conserving every dollar. Nothing was ever purchased on impulse. I also got into the habit of tracking prices. I knew what I would need and when, and I could use my price database to tell me where to go and how much money I'd need.

Now that money is not as limited, I still run fairly conservatively. A dollar is never thought of in terms of how much work I had to do to get it. Nor is it simply just something that comes in on the regular basis.

So, how do I think about money? Well, I'm looking at a new laptop. It's priced at $400. $400 at a 6% yield is $24/year. That's .24% towards the red line, or about 1/417th. That's very significant to me. Even $10, $0.6/year gets me that much closer. Likewise, I view my typical pay cheque as being roughly $55/year towards my goal. That's a little over half a percent there. As long as I'm trading time for money to make ends meet, I've got to be careful how much money I deem expendable. My time is not disposable, ergo, income obtained from time is not disposable income.

If all goes well, one of my big personal loans should get repaid on Friday. I'm really looking forward to that. Though I've had the lingering feeling that I've got too much cash sitting around for a while now, so I've got to find a place to put that stuff. I also want to open up a new discount brokerage account.

To do list for the week:

Clean room

Decide on specific preferred shares to go after

Revisit asset allocation-dividend yielding common stock is very attractive right now too

Figure out REIT financial statements-My knowledge of these are largely conceptual, but they look like a good way to start off my fledgling source of non-employment income

Estimate time to the red line-I'm not sure if I really want to do that at this point

Now that money is not as limited, I still run fairly conservatively. A dollar is never thought of in terms of how much work I had to do to get it. Nor is it simply just something that comes in on the regular basis.

So, how do I think about money? Well, I'm looking at a new laptop. It's priced at $400. $400 at a 6% yield is $24/year. That's .24% towards the red line, or about 1/417th. That's very significant to me. Even $10, $0.6/year gets me that much closer. Likewise, I view my typical pay cheque as being roughly $55/year towards my goal. That's a little over half a percent there. As long as I'm trading time for money to make ends meet, I've got to be careful how much money I deem expendable. My time is not disposable, ergo, income obtained from time is not disposable income.

If all goes well, one of my big personal loans should get repaid on Friday. I'm really looking forward to that. Though I've had the lingering feeling that I've got too much cash sitting around for a while now, so I've got to find a place to put that stuff. I also want to open up a new discount brokerage account.

To do list for the week:

Clean room

Decide on specific preferred shares to go after

Revisit asset allocation-dividend yielding common stock is very attractive right now too

Figure out REIT financial statements-My knowledge of these are largely conceptual, but they look like a good way to start off my fledgling source of non-employment income

Estimate time to the red line-I'm not sure if I really want to do that at this point

Thursday, March 27, 2008

When the most logical course of action is to sit still

Life might not be getting anywhere right now, but I try to remind myself that change for the sake of change is a futile process. I often find myself wondering if I am doing the right thing. Emotionally, it doesn't sit too well. Keeping with the space travel analogy that I started this blog with, if all you had was all the fuel in the world, it's exceedingly easy to put yourself in the middle of nowhere. Let's face it, space is called space because there's a heck of a lot of vast open space out there. I'm also not fond of the setting out with little more than the clothes on my back feeling that I had when I started university. Besides accumulating resources, I've also been:

One of the things I looked into was going into air traffic control. I was told that I was crazy for even considering it and that I can't waste money training for something that there's little demand for. Then they waited till my brother was over to ask him about the demand for air traffic controllers. It's not a mishmash of different agencies where you have to convince someone to hire you afterwards. Everything is controlled by one agency, the employer. Parts of the process are contracted out, but they have a good process set up that weeds out practically anyone who wouldn't be at it for life, they'll also only train as many people as they think they'll need and they'll only train the best of them. It costs $1000 for training, which includes room and board. You'd probably be hard pressed to find four months of food for that much, let alone a place to stay and job training. I'm not totally convinced that's what I want to do with the rest of my life.

Something else I looked into was teaching English overseas. Mainly looked into it because something had me wanting to see what life was like in china where my parents come from. My dad was real excited about this idea. My mom kept pressuring me to make a quick decision on it. Neither of them seemed to show any appreciation for the fact that, it's almost a 1/3rd pay cut from the job I have now and I can expect to make about 1/2 of what I'll be making at the position I'm currently training for.

An idea put forward by my dad was to go into dentistry. Another idea that I had was to go into optometry. The prerequisite for both is fairly similar to a premed program. When I told them how the entry process for optometry went, my parents immediately tried to discourage me away from it. After I pointed out that they thought dentistry was a good idea and the dust settled for a few minutes, I was told that I didn't need another degree because I already have one and they lectured me again on doing research instead of just dreaming. So I looked up the entry requirements and read them out to them.

It's all a retelling of the story of the path I made down the side of the house. When I started, I started under the assumption that they had measured things and started spacing the stones fairly close together, like most stone paths. I got about half way down and went looking for more stones. When it became apparent that was all I had to play with, I tried to decide between even spacing and roughly one pace spacing. Then I set off to space the stone one pace apart. There were a few stones left over, which now level the garbage can. For months, I was pestered to finish the path. I had no idea what they wanted me to do to it. When asked to clarify what they wanted, I was told that the minimum requirement was to get from the front to the back. This puzzled me further as I could do it with my eyes closed. After all, I had spaced them one pace apart based off how I walked. They yelled at me, called me lazy and what not and I couldn't figure out what they wanted me to do. Then one day, "Thanks for finally finishing the path." "Umm, it doesn't look any different to me." "So it's been like this all along?" "It's been like this for months You've had me going crazy trying to figure out what you wanted done with it because you've been too lazy to look at the side of the house?" "Well, you never do any work, I never see you doing any work." Sure, yell at me for not slaving away at something because I finished it months ago and you've simply been too lazy to check on it.

I'll get to watch this again when their attitude bites them in the ass one more time when it comes time to pay for my sister's schooling. I don't know enough about their employer pension plans to guess when the discrepancy between their idea of what's going on and how things really are bites them hard. There's still a chance that it might not, but I'm leaning towards impending doom.

- researching different parts of the country that I might want to move to

- looking into the requirements for moving to the USA

- examining the costs and potential returns of buying a small business

- doing a feasibility study for a business idea that I have and might want to take up

- exploring the entry requirements and long term prospects of different career paths

One of the things I looked into was going into air traffic control. I was told that I was crazy for even considering it and that I can't waste money training for something that there's little demand for. Then they waited till my brother was over to ask him about the demand for air traffic controllers. It's not a mishmash of different agencies where you have to convince someone to hire you afterwards. Everything is controlled by one agency, the employer. Parts of the process are contracted out, but they have a good process set up that weeds out practically anyone who wouldn't be at it for life, they'll also only train as many people as they think they'll need and they'll only train the best of them. It costs $1000 for training, which includes room and board. You'd probably be hard pressed to find four months of food for that much, let alone a place to stay and job training. I'm not totally convinced that's what I want to do with the rest of my life.

Something else I looked into was teaching English overseas. Mainly looked into it because something had me wanting to see what life was like in china where my parents come from. My dad was real excited about this idea. My mom kept pressuring me to make a quick decision on it. Neither of them seemed to show any appreciation for the fact that, it's almost a 1/3rd pay cut from the job I have now and I can expect to make about 1/2 of what I'll be making at the position I'm currently training for.

An idea put forward by my dad was to go into dentistry. Another idea that I had was to go into optometry. The prerequisite for both is fairly similar to a premed program. When I told them how the entry process for optometry went, my parents immediately tried to discourage me away from it. After I pointed out that they thought dentistry was a good idea and the dust settled for a few minutes, I was told that I didn't need another degree because I already have one and they lectured me again on doing research instead of just dreaming. So I looked up the entry requirements and read them out to them.

It's all a retelling of the story of the path I made down the side of the house. When I started, I started under the assumption that they had measured things and started spacing the stones fairly close together, like most stone paths. I got about half way down and went looking for more stones. When it became apparent that was all I had to play with, I tried to decide between even spacing and roughly one pace spacing. Then I set off to space the stone one pace apart. There were a few stones left over, which now level the garbage can. For months, I was pestered to finish the path. I had no idea what they wanted me to do to it. When asked to clarify what they wanted, I was told that the minimum requirement was to get from the front to the back. This puzzled me further as I could do it with my eyes closed. After all, I had spaced them one pace apart based off how I walked. They yelled at me, called me lazy and what not and I couldn't figure out what they wanted me to do. Then one day, "Thanks for finally finishing the path." "Umm, it doesn't look any different to me." "So it's been like this all along?" "It's been like this for months You've had me going crazy trying to figure out what you wanted done with it because you've been too lazy to look at the side of the house?" "Well, you never do any work, I never see you doing any work." Sure, yell at me for not slaving away at something because I finished it months ago and you've simply been too lazy to check on it.

I'll get to watch this again when their attitude bites them in the ass one more time when it comes time to pay for my sister's schooling. I don't know enough about their employer pension plans to guess when the discrepancy between their idea of what's going on and how things really are bites them hard. There's still a chance that it might not, but I'm leaning towards impending doom.

Quick Glance at Preferred Shares

As I calculated earlier, I found that I should be looking for 7.75% return on ordinary income, 6.64% on capital gains and 5.64% on eligible dividends. So, how realistic are these figures in the short term? Well, I figure with things like the latest BMO offering at 5.8% is a decent indicator. The question is, do I want to incur the risk associated with preferred shares. As I understand it, the company could decide not to declare dividends, perceived risk of the company could increase and result in a capital loss, when interest rates go up, current issues will appear less desirable and the price will fall. Of course, the thing is, that when interest rates start going up, economic outlook should be somewhat improved and there'll be less perceived risk in the issuers, maybe those two effects will balance out. So take a chance and roll the dice?

Before I gamble, I always check the odds. There's trying to predict the weather and trying to predict the seasons. The information that I have available to me include the company's credit rating, the financial statements, performance of the common stock, and adviser commentary.

My potential losses at worst, I loose what I invest. I feel that the likelihood of this happening is rather small given the tools that are available to me. However, the Bear Stears collapse was pretty much a surprise to everyone. The effect of an event like this can also be reduced by spreading the risk around so that if one goes under, it isn't too significant of a portion of my investments.

A next step up from that, dividends are suspended. The company can then die a slow death and people won't notice for a while, or it can be just temporary. As I understand it, suspending dividends on preferred shares isn't something a company does lightly. They're usually in trouble at that point. If this happens, I suspect that the result will be largely the same as the above scenario, only a portion of my investment will be recoverable instead of the whole thing. The whole thing could also blow over and see dividends resume with a battered share price.

Share prices could fall. A portion of my capital will be unrecoverable, but income will continue. It might scare me in the short term if the drop is significant, but odds are, I'll be ok with things once the price stabilizes.

This feels like quite a bit of risk to take on for 0.16%. If this were all I was looking at, I'd step away. Though the story of my life isn't about avoiding risk. Anyone who's tried playing blackjack or poker seriously knows that it's about evaluating risk and making safe bets, not avoiding it. Maybe if the bank makes another 0.25% drop in interest rates, it'll make things more attractive. I see the real possibility for another drop in interest rates. Before making blanket decisions based on one issue, what else is out there? Not that I'm questioning the stability of the Bank of Montreal or anything like that.

Hymas put together a pretty good information table at www.prefinfo.com, Hymas also maintains a commentary at www.prefblog.com. I can also hunt down what else is out there using the Dominion Bond Rating Service, and it'll rate the financial health of the company for me too. Newspaper stock listings also seem to be a good place to look for just figuring out what's out there. I'm going to refrain from commenting on specific issues.

Before I gamble, I always check the odds. There's trying to predict the weather and trying to predict the seasons. The information that I have available to me include the company's credit rating, the financial statements, performance of the common stock, and adviser commentary.

My potential losses at worst, I loose what I invest. I feel that the likelihood of this happening is rather small given the tools that are available to me. However, the Bear Stears collapse was pretty much a surprise to everyone. The effect of an event like this can also be reduced by spreading the risk around so that if one goes under, it isn't too significant of a portion of my investments.

A next step up from that, dividends are suspended. The company can then die a slow death and people won't notice for a while, or it can be just temporary. As I understand it, suspending dividends on preferred shares isn't something a company does lightly. They're usually in trouble at that point. If this happens, I suspect that the result will be largely the same as the above scenario, only a portion of my investment will be recoverable instead of the whole thing. The whole thing could also blow over and see dividends resume with a battered share price.

Share prices could fall. A portion of my capital will be unrecoverable, but income will continue. It might scare me in the short term if the drop is significant, but odds are, I'll be ok with things once the price stabilizes.

This feels like quite a bit of risk to take on for 0.16%. If this were all I was looking at, I'd step away. Though the story of my life isn't about avoiding risk. Anyone who's tried playing blackjack or poker seriously knows that it's about evaluating risk and making safe bets, not avoiding it. Maybe if the bank makes another 0.25% drop in interest rates, it'll make things more attractive. I see the real possibility for another drop in interest rates. Before making blanket decisions based on one issue, what else is out there? Not that I'm questioning the stability of the Bank of Montreal or anything like that.

Hymas put together a pretty good information table at www.prefinfo.com, Hymas also maintains a commentary at www.prefblog.com. I can also hunt down what else is out there using the Dominion Bond Rating Service, and it'll rate the financial health of the company for me too. Newspaper stock listings also seem to be a good place to look for just figuring out what's out there. I'm going to refrain from commenting on specific issues.

Wednesday, March 26, 2008

I saw something on TV that really hit me recently. A lot of bad things hae happened to me in the past. More to the point, those closest to me, who should be protecting me, have done a lot of bad things to me. I try not to get too caught up in it, but at times I worry if it's made me too self centered or unable to accept responsibility for things. I worry about reality becoming twisted in my mind and I worry about turning into a monster.

I'm not sure how to let go of things but I am slowly starting to. Last week at work, I took some time to practice my writing. Having neater writing is a very big deal for me. It's the central theme to the story I usually tell people about my past.

My parents did a lot of things to me. They were never happy with the way I wrote. My mom kept trying to ruin my proper pencil grip to some system where the thumb was twisted so unnaturally. Anyway, they had me doing things like copying out the alphabet over and over again. They made me keep a diary and they'd read through it and punish me for spelling things incorrectly, make fun things I wrote or just get annoyed at the lack of neatness in my penmanship. Things got to me. One day I refused to write out the alphabet yet again. As a result, I was spanked with whatever happened to be around, in this case, some wooden paint stirring sticks. It's flimsy stuff, so that snapped easily. Those who've snapped wood before should be familiar with how it tends to split along the grain. This left some rather sharp instruments for my parents. They wound up stabbing me in the rear with them. Of course, the wood broke again. I don't remember why they left after that. I just remember that I was home alone for a while with some bleeding and fragments of wood stuck in me rather deep. It wasn't like a little sliver, they must have been at least one, maybe two inches deep. It was a serious wound that I had to treat by myself. I didn't know much then, but for a while, I was really scared. As for why they left, I can say for sure that it wasn't shock. They didn't go away to calm down after what they had done. I know this for certain because when they returned, I was yelled at for not finishing the exercises I had refused to do that lead to this. There were no apologies, my wounds received no treatment other than my own.

It hurts every time someone asks me how I can possibly be bitter at my parents. With childhood memories like that, it's an insult that I'm asked to justify my anger. That seems to be the story that I tell most often. It seems to be the most extreme.

There's also another story that I tend to tell quite frequently. I tell it because there's a scar on my wrist to remind me of it. I got that scar when my sister bit me. She's seven years younger than I am. My brother would always be placing my toys in her toy box and she'd ruin them or refuse to return them or something. I saw her with one of my toys and chased her into a corner trying to get it back. She bit me to get away. I screamed and everyone came rushing to help. Within seconds everyone was gathered around checking to see if everything was ok, giving comfort and assurances where it was needed, and checking for injuries. This would be nice if she was the one hurt. Once again, I was left to tend to my own wounds. I was the one on the floor screaming and clutching a bleeding wound. Of course my sister is fine, she's the assailant. I on the other hand was the victim and was not ok. I needed first aid, which I had to provide myself because everyone was ignoring me.

I'm not sure how to let go of things but I am slowly starting to. Last week at work, I took some time to practice my writing. Having neater writing is a very big deal for me. It's the central theme to the story I usually tell people about my past.

My parents did a lot of things to me. They were never happy with the way I wrote. My mom kept trying to ruin my proper pencil grip to some system where the thumb was twisted so unnaturally. Anyway, they had me doing things like copying out the alphabet over and over again. They made me keep a diary and they'd read through it and punish me for spelling things incorrectly, make fun things I wrote or just get annoyed at the lack of neatness in my penmanship. Things got to me. One day I refused to write out the alphabet yet again. As a result, I was spanked with whatever happened to be around, in this case, some wooden paint stirring sticks. It's flimsy stuff, so that snapped easily. Those who've snapped wood before should be familiar with how it tends to split along the grain. This left some rather sharp instruments for my parents. They wound up stabbing me in the rear with them. Of course, the wood broke again. I don't remember why they left after that. I just remember that I was home alone for a while with some bleeding and fragments of wood stuck in me rather deep. It wasn't like a little sliver, they must have been at least one, maybe two inches deep. It was a serious wound that I had to treat by myself. I didn't know much then, but for a while, I was really scared. As for why they left, I can say for sure that it wasn't shock. They didn't go away to calm down after what they had done. I know this for certain because when they returned, I was yelled at for not finishing the exercises I had refused to do that lead to this. There were no apologies, my wounds received no treatment other than my own.

It hurts every time someone asks me how I can possibly be bitter at my parents. With childhood memories like that, it's an insult that I'm asked to justify my anger. That seems to be the story that I tell most often. It seems to be the most extreme.

There's also another story that I tend to tell quite frequently. I tell it because there's a scar on my wrist to remind me of it. I got that scar when my sister bit me. She's seven years younger than I am. My brother would always be placing my toys in her toy box and she'd ruin them or refuse to return them or something. I saw her with one of my toys and chased her into a corner trying to get it back. She bit me to get away. I screamed and everyone came rushing to help. Within seconds everyone was gathered around checking to see if everything was ok, giving comfort and assurances where it was needed, and checking for injuries. This would be nice if she was the one hurt. Once again, I was left to tend to my own wounds. I was the one on the floor screaming and clutching a bleeding wound. Of course my sister is fine, she's the assailant. I on the other hand was the victim and was not ok. I needed first aid, which I had to provide myself because everyone was ignoring me.

Tuesday, March 25, 2008

Sorting the mess

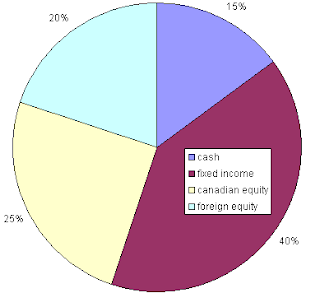

Before sitting down to figure things out, I went to one of those online asset mix things that try to advise you on where you should keep your money. It spat this out at me.

I'm not sure what I really want to do with this, but I'll keep it in the back of my mind somewhere. Rather than try to stick to some ratios, I'm going to just take a sort of grocery shopping approach and pick up what seems to be a good idea at the moment.

At the moment, I'm kind of happy with this. 15% cash feels a tad high for my liking, but right now, my pie is rather small and equities generally like to move in board lots so having a high percentage of cash is unavoidable. Other than that, I guess it kind of represents my general sentiment.

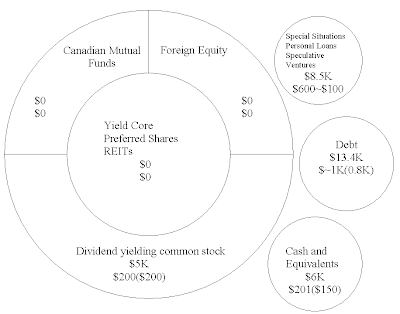

I came up with a kind of different breakdown for things. It just works better for my thinking. What I've got here at the moment is the amount, then bellow that pre-tax and expected after tax income.

I came up with a kind of different breakdown for things. It just works better for my thinking. What I've got here at the moment is the amount, then bellow that pre-tax and expected after tax income.Starting from the top right, if I can't can't really count on it, I'm not going to think of it as being part of my main investments.

My loans also need some attention. Right now, they dictate my minimally acceptable rate of return. They're at a rate of prime+2.5, paid with pre-tax dollars. With a current prime rate of 5.25%, that's 7.75%. If I stick in the lowest tax bracket, that'll be 5.8125% and 5.27% if I slide up to the next bracket. For now, I think I'll assume I stay in the lowest tax bracket. Using marginal tax rates from http://www.morningstar.ca/globalhome/MarginalTaxCalculator/index.asp I'll need a return of 7.75% on ordinary income, 5.64% on dividends, and 6.64% on capital gains. Off hand, that feels a wee bit optimistic in the short term, and overall not too bad. Though I'm still young and I have little experience in these things, so I could find out the hard way that I'm wrong. For me, things will probably be a mix of dividends and unrealized capital gains. Granted, those aren't exactly too spendable. Just what sort of a return I'll need when splitting the two is spread sheet time. For what it's worth, if it were any type of non-tax deductible loan, I'd need an ordinary income return of 9.69%, which is pushing it.

A sense of macro economics helps or planning. Right now, I feel that I can count on the USA keeping interest rates pinned down for the rest of us. Then there's the slowing economy and lower inflation due to valuation on the dollar. There's also a bit of a sentiment that the dollar is too high and should be pushed lower to help struggling manufacturers. In the short run, I think trying to generate a better return is an idea that should be considered. In the longer term, if it starts becoming a better idea to pay off my loan first, I can always pay it off at a later date

I generally don't think of cash as being an investment. I kind of view it as a waiting spot for when I'm deciding on an investment. Generally, I've seen it recommended as allowing for flexibility to take advantage of opportunities as they arise. So it kind of sits outside for now.

Instead of having a conventional pie graph, my short term goal is to be able to make ends meet without needing to work in a rather minimalist sense. It would make me feel a lot more secure and give me the flexibility I want to explore a bit. Granted, I could just save money for that. However, I'd feel a lot more free and secure if I could get an income stream off my investments. For the ease of mental arithmetic, I've decided on an initial goal of $10,000/year total income plus enough cash to pay off my loans. I'll dub that mark, the red line. The minimum wage+vacation pay+stat holiday mark shall be referred to as the green line and I suppose somewhere in between should be a yellow line, so lets call that $10,000+loan payments = $12,710.

So, now the question is, since this is a give me some lee way to be unemployed for a while, do I want to presume that I am unemployed in this presently fictitious scenario? Do I want to calculate as if it's on top of something that's already pushed me into the lowest tax bracket? For that matter, do I want to calculate for other parts of Canada as well since I want to relocate. It's an arbitrary choice, and I'm split between calculating as if I'm in the lowest tax bracket already and calculating pre-tax. For now, I suppose lowest tax bracket works. I'm 3.5% towards the red line, and 2.75% towards the yellow line. I have trouble remembering where the green line is off-hand, but it's still a long ways to go for that, so I'll think about it when I'm a bit closer.

Why you need health to have healthy finances

I know I said no more bail outs, but one of my friends took a bit of sick time lately and as a result couldn't afford food and was five days away from pay day. It's just a small amount, but I suppose that's how things add up. We overlook just how frequently these small amounts happen. If employment income is important, then you gotta make sure you're in a condition to show up for work when you're scheduled.

I'm glad I seldom get sick. Hopefully it stays that way. I try to look after my health. I don't get much fast food, though my diet lacks dairy as well as fruits and vegetables. I'm also staying physically fit, don't smoke, no drugs or alcohol. Well, room for improvement, I should try for a more balanced diet.

I'm glad I seldom get sick. Hopefully it stays that way. I try to look after my health. I don't get much fast food, though my diet lacks dairy as well as fruits and vegetables. I'm also staying physically fit, don't smoke, no drugs or alcohol. Well, room for improvement, I should try for a more balanced diet.

Monday, March 24, 2008

Feel good moment

Proving to myself that I'm still a good person is an important thing to me. I kind of feel that I've gotten a little scary lately and to a point, I suppose I'm blaming myself for a break up I had earlier. Last week, I found a cell phone on the bus. Gave it to the driver for the lost and found. Had the same driver yesterday and she told me that the person who got off on the stop that I got on was the owner of the cell phone. Apparently, he's very happy to have it back. I like getting closure on things like that. Makes me feel good.

Friday, March 21, 2008

Taking Inventory

Where do I sit right now? At the start of the year, I had two student loans at an interest rate of prime +2.5% for roughly $4.6K and $9.3K. Now that it's nearly a third of the way through the year, the amount has gone down a tad. Between the two of them, there's $2710.92 in payments to be made this year. I'll estimate that about $1000 of that will be interest and that's tax deductible, so I should get about $250 of it back on my tax return.

Besides that, I should be getting about $2000 back on my income tax. I'm going to be getting $4000 back for a personal bail out loan that I made earlier and I'm not sure if I'll be getting all of another $2000 I loaned out back this year. I'm determined not to make any more personal loans for a while. $6K tied up in loans with another $2K in tax refunds is quite a significant portion of my net worth at the moment.

I'm purposefully ignoring the amount I have in my RRSP at the moment, because my goals are more short term than when I turn 65. Though off the top of my head, I'd guess there's about $7.5K in there.

Then there's about $5K in common stock and $1.5K in income trusts, with a combined yield of about $300/year right now. Then there's about $6K in cash getting 3.35%.

Umm, this is a seriously disorganized mess. First order of business should be categorizing things. Second order of business, I've been running under the assumption that I can get a better after tax return investing my money than paying off my loans, I should revisit that.

Money aside, I also have decent health. I seldom get sick and seldom stay sick for long. I do however worry about my health. My family has a history of autoimmune disease and I worry that I might be affected too. I'm also decently fit. Currently I've got a decent amount of employment income coming in. I'll have to say that my job sucks, I hate it and it really tears me apart. I also have a couple good friends. Moral support can't be neglected at a time like this. Granted, I seem to be the only one of them trying to build a financial safety net. See above regarding ~$6k of bail outs. I will get to a point where I feel I have some security before making any more personal loans.

Besides that, I should be getting about $2000 back on my income tax. I'm going to be getting $4000 back for a personal bail out loan that I made earlier and I'm not sure if I'll be getting all of another $2000 I loaned out back this year. I'm determined not to make any more personal loans for a while. $6K tied up in loans with another $2K in tax refunds is quite a significant portion of my net worth at the moment.

I'm purposefully ignoring the amount I have in my RRSP at the moment, because my goals are more short term than when I turn 65. Though off the top of my head, I'd guess there's about $7.5K in there.

Then there's about $5K in common stock and $1.5K in income trusts, with a combined yield of about $300/year right now. Then there's about $6K in cash getting 3.35%.

Umm, this is a seriously disorganized mess. First order of business should be categorizing things. Second order of business, I've been running under the assumption that I can get a better after tax return investing my money than paying off my loans, I should revisit that.

Money aside, I also have decent health. I seldom get sick and seldom stay sick for long. I do however worry about my health. My family has a history of autoimmune disease and I worry that I might be affected too. I'm also decently fit. Currently I've got a decent amount of employment income coming in. I'll have to say that my job sucks, I hate it and it really tears me apart. I also have a couple good friends. Moral support can't be neglected at a time like this. Granted, I seem to be the only one of them trying to build a financial safety net. See above regarding ~$6k of bail outs. I will get to a point where I feel I have some security before making any more personal loans.

Wednesday, March 19, 2008

Setting Goals/Hitting a moving target

There are a lot of things I'd like to do, though for now the one that I really need to do is live. Since I'm not currently on my own trying to do that, I've got to estimate the cost instead of simply tallying receipts. Of course, the cost of living changes continuously.

So, what sort of information do I have out there? Yeah, I could run around trying to total everything I think I'd need, or I can use someone else's estimates. One estimate that I'm familiar with is the student loan monthly living allowance. It naturally assumes that you'll be living like a student, which is fine with me. As much as I had some bad experiences, people smoking pot and getting me high, people skipping out on rent, utilities not getting paid, the times when things went well were good times. A new one that's recently been introduced to me is what Old Age Security(OAS) and Canada Pension Plan (CPP) will give. I'll have to admit that I don't know how they arrive at the figure. I'm learning about those because my dad recently retired. Finally, there's whatever minimum wage is set at, which is quite livable.

I'm expecting these to cover a bit above what's needed to cover the essentials. Different people will inevitably have a different view on what is essential. When I was going through school, I was well bellow the monthly living allowance. Though I was almost always perpetually short money, but that's another story for another day.

And I quickly begin to question the value of this exercise. If I want to make things even more convoluted, 3.07% of the consumer price index is based off alcohol and tobacco, which I currently do not consume, so should I be able to decrease these figures by 3.07%? Anyway, ball park figure, I'd feel fairly secure if I could get about $10K/a from investments. I'll be really happy if I could pull off $18K/a. Of course that assume no economic down turn, like the one happening to the south of me at the moment.

So, what sort of information do I have out there? Yeah, I could run around trying to total everything I think I'd need, or I can use someone else's estimates. One estimate that I'm familiar with is the student loan monthly living allowance. It naturally assumes that you'll be living like a student, which is fine with me. As much as I had some bad experiences, people smoking pot and getting me high, people skipping out on rent, utilities not getting paid, the times when things went well were good times. A new one that's recently been introduced to me is what Old Age Security(OAS) and Canada Pension Plan (CPP) will give. I'll have to admit that I don't know how they arrive at the figure. I'm learning about those because my dad recently retired. Finally, there's whatever minimum wage is set at, which is quite livable.

I'm expecting these to cover a bit above what's needed to cover the essentials. Different people will inevitably have a different view on what is essential. When I was going through school, I was well bellow the monthly living allowance. Though I was almost always perpetually short money, but that's another story for another day.

| Source | Amount | Annual | |

| Student monthly living allowance | $897/month | 10764 | |

| Old Age Security | $502.31/month | 6027.72 | |

| Guaranteed Income Supplement | $634.02/month | 7608.24 | |

| Allowance??? | $921.00/month | 11052 | |

| CPP starting at Age 65 | $884.58/month | 10614.96 | |

| Minimum wage at 40 hours a week for 52 weeks | $8.40/hr | 17472 | |

| Minimum wage at 40 hours a week for 52 weeks with vacation pay | $8.40/hr | 18170.88 | |

| Minimum wage at 40 hours a week for 52 weeks with vacation pay and 11 stat holidays | $8.40/hr | 18910.08 |

And I quickly begin to question the value of this exercise. If I want to make things even more convoluted, 3.07% of the consumer price index is based off alcohol and tobacco, which I currently do not consume, so should I be able to decrease these figures by 3.07%? Anyway, ball park figure, I'd feel fairly secure if I could get about $10K/a from investments. I'll be really happy if I could pull off $18K/a. Of course that assume no economic down turn, like the one happening to the south of me at the moment.

Tuesday, March 18, 2008

About the Gravitation Sling Shot

The gravitational sling shot can very simplistically be described as the art of plummeting towards something that'll kindly step out of the way for you. Since the point you're falling towards is shifting, you effortlessly change speed and direction.

It seems to be a better analogy for what I want to do than hitting rock bottom and bouncing back. Things might be falling apart right now, but I'm going to try to keep things controlled and avoid a total shattering.

A variation on this is the Oberth effect, where you want to hit the engines where you've got your highest speed. You get the same amount of speed increase for the amount of fuel you burn, but you get more energy out of it and hence go further.

With my sister getting ready to go off to school, I can't stay here for too long. My parents want to sell the house soon. I'm not sure if they're going towards selling when she starts or waiting till its over.

That's going to be another thing just waiting to crumble. I haven't heard anything about any plans to pay for her schooling. They've been telling me that I should go back to school too while they have money saved up. There's about $20K saved up. I wonder if they know that if they had actually met their expectations instead of having me lie to get loans and grants, all that would have been gone half way through third year. I sure hope that some of the money from downsizing housing goes towards covering her schooling.

Well, getting back to me, my expenses are going up when she leaves, so I'm hunting down investments to augment my income. I'm going to need a lot of extra income to start my life over again.

It seems to be a better analogy for what I want to do than hitting rock bottom and bouncing back. Things might be falling apart right now, but I'm going to try to keep things controlled and avoid a total shattering.

A variation on this is the Oberth effect, where you want to hit the engines where you've got your highest speed. You get the same amount of speed increase for the amount of fuel you burn, but you get more energy out of it and hence go further.

With my sister getting ready to go off to school, I can't stay here for too long. My parents want to sell the house soon. I'm not sure if they're going towards selling when she starts or waiting till its over.

That's going to be another thing just waiting to crumble. I haven't heard anything about any plans to pay for her schooling. They've been telling me that I should go back to school too while they have money saved up. There's about $20K saved up. I wonder if they know that if they had actually met their expectations instead of having me lie to get loans and grants, all that would have been gone half way through third year. I sure hope that some of the money from downsizing housing goes towards covering her schooling.

Well, getting back to me, my expenses are going up when she leaves, so I'm hunting down investments to augment my income. I'm going to need a lot of extra income to start my life over again.

Monday, March 17, 2008

Welcome

Welcome to my blog. I started this blog to record my efforts to try to restart my life. A while ago, I graduated with a B.Eng in aerospace engineering. I heard things were booming in Calgary, and my parents live here, so I went back to Calgary to look for work. Things were supposed to be good.

Instead, things just went down from there. Instead of being helpful, my parents simply drove my stress level up. Every time I applied somewhere, my parents would ask why I didn't apply sooner. I'd get told to do things that I had already done, like get my resume reviewed, which was happening on the regular basis. They'd make the same suggestions over and over again as if that was all I needed to do despite the fact that I was already doing better than that. Pretty soon, their interrogations were the focus of my life, instead of my job search. It got to a point where I wasn't able to sleep. I blame them for ruining my life.

There's actually a long history of serious tension between me and the rest of my family. There's a bunch of stories that I usually tell. Right now, there's one that's been weighing heavily on my mind that doesn't get told too often. My parents felt that I had an over active imagination as a kid. One of the things they did to try to suppress it was that one day, I was denied food. My mom just said, "See if your imagination can fool you."

I hate them for a lot of things, though for now, I have to use every resource I can, including them. When I finally have the resources to stand on my own, it's going to be for good. My goal is to be gone without a trace. When I leave, I'm sure I'll use that quote.

Instead, things just went down from there. Instead of being helpful, my parents simply drove my stress level up. Every time I applied somewhere, my parents would ask why I didn't apply sooner. I'd get told to do things that I had already done, like get my resume reviewed, which was happening on the regular basis. They'd make the same suggestions over and over again as if that was all I needed to do despite the fact that I was already doing better than that. Pretty soon, their interrogations were the focus of my life, instead of my job search. It got to a point where I wasn't able to sleep. I blame them for ruining my life.

There's actually a long history of serious tension between me and the rest of my family. There's a bunch of stories that I usually tell. Right now, there's one that's been weighing heavily on my mind that doesn't get told too often. My parents felt that I had an over active imagination as a kid. One of the things they did to try to suppress it was that one day, I was denied food. My mom just said, "See if your imagination can fool you."

I hate them for a lot of things, though for now, I have to use every resource I can, including them. When I finally have the resources to stand on my own, it's going to be for good. My goal is to be gone without a trace. When I leave, I'm sure I'll use that quote.

Subscribe to:

Posts (Atom)